Telefone do Banco Superdigital

O Telefone do Banco Superdigital e outras formas de relacionamento com a Instituição são informações muito procuradas na internet pelos clientes da instituição que visam sobretudo resolver pendências com este Banco Digital.

A Superconta digital nasceu em 2012 com o objetivo de simplificar a vida financeira dos clientes das redes bancárias. Como é comum nos bancos deste segmento, o foco é em tecnologia e praticidade. Em 2017, o Santader comprou a empresa e ampliou as opções de serviço, se tornando um produto para competir com o Nubank, o Inter e outras plataformas bancárias digitais. Em 2018 o Superdigital ampliou ainda mais as suas operações se tornando uma empresa mundial com operações no Chile.

Atualmente a Superdigital conta com mais de 1,9 milhões de contas abertas e mais de 2,9 milhões de Cartões físicos e virtuais emitidos. Como podemos perceber, é uma instituição que vem crescendo e ganhando espaço no mercado financeiro brasileiro e mundial.

Telefone do Banco Superdigital: como entra em Contato?

O Banco Superdigital disponibiliza diversos canais de atendimento aos clientes que contam com um amplo leque de opções para resolver pendências, fazer transações e em alguns casos fazer também algum tipo de reclamação sobre a fintech.

Central de Atendimento Superdigital

Você pode entrar em contato com a central de atendimento superdigital através do telefone:

- 4090-1450 (Capitais e Regiões Metropolitanas)

- 0800-090-1450 (Demais localidades)

SAC SuperDigital

O SAC supergital é o serviço para resolver pendências e tirar dúvidas com a institução. Para falar com este serviço, você pode ligar no 0800-787-3772.

Chat SuperDigital

O chat online está disponível 24 horas, 7 dias por semana. Clique no botão Iniciar atendimento via chat.

Dúvidas e Reclamações SuperDigital

Você já conhece a área de Perguntas Frequentes? Lá você encontrará as respostas para as principais dúvidas sobre o SuperDigital. Não encontrou o que precisa? Entre em contato através dos canais informados anteriormente.

SuperDigital nas Redes Sociais

Ouvidoria SuperDigital

Para ligar na Ouvidoria do SuperDigital, tenha em mãos o protocolo de seu último atendimento. Ligue para 0800-757-3777 de segunda a sexta das 8h às 22h e sábado das 9h às 14h, exceto feriados.

A ouvidoria é um órgão específico que existe dentro da empresa e que possui um papel muito importante.Isso porque é através desse setor, da ouvidoria, que a empresa consegue avaliar, identificar e acompanhar o padrão de atendimento de seu quadro de funcionários.

Em geral, as pessoas acabam contatando uma ouvidoria quando possuem um problema com a empresa e o atendimento comum, infelizmente, não consegue resolver essa questão.

A ouvidoria do Banco Superdigital , portanto, deve ouvir as reclamações de seus clientes e possui o dever de garantir que a demanda seja investigada e avaliada sempre de maneira imparcial e justa.

Cada empresa define uma tratativa e o próprio funcionamento do setor. Algumas, por exemplo, acabam optando por terceirizar esse serviço, a fim de garantir uma imparcialidade maior.

Outras, optam por selecionar os próprios funcionários da empresa, que já conhecem os valores da empresa, política de trocas ou devolução, além dos processos de reembolso.

Na Ouvidoria do Banco Superdigital, você poderá apresentar elogios, sugestões, solicitações, denúncias, manifestações e reclamações.

O interessante da ouvidoria é que, além de investigar a sua questão, ela também gera um efeito na empresa.

Assim, a resposta sobre quando acionar uma ouvidoria Banco Superdigital já está bem clara.A ouvidoria deve ser acionada depois de esgotadas todas as possibilidades de negociações e contatos com a empresa através dos canais mais tradicionais.Portanto, considere acionar uma ouvidoria como sua última instância, como um canal específico para abrir uma ocorrência sobre o seu problema.Deixe para buscar a ouvidoria quando o seu problema não for resolvido pelo serviço de atendimento ao cliente.

Reclamação no Banco Central do Brasil

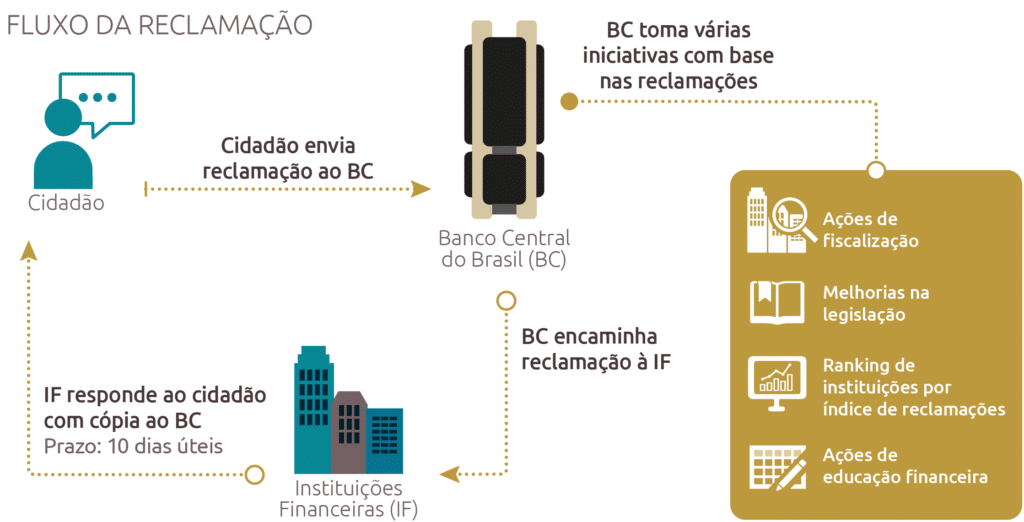

Muitos usuários de serviços bancários não sabem, mas ao ter algum tipo de problema com um banco e este não resolver através da sua ouvidoria, uma alternativa muito prática e viável é fazer uma reclamação junto ao Banco Central.

O Banco Central do Brasil é uma instituição muito conceituada e entre outras atribuições ele tem o papel de fazer a regulação e a supervisão do sistema financeiro nacional. A Instituição atualmente também trabalha assegurando a estabilidade do poder de compra do dinheiro.

No caso específico dos Bancos, o Banco Central fiscaliza e controla as instituições bancárias, visando com isso evitar os abusos e outras arbitrariedades que possam estar sendo cometidas pelos agentes financeiros do país.

Portanto, se você teve um problema mais grave com o Superdigital ou qualquer outra instituição financeira e este problema não foi resolvido pela ouvidoria, você pode cadastrar a sua manifestação de forma bem simples no site do Banco Central.

Uma vez realizada a reclamação, o Banco Central vai entrar em contato direto com o Superdigital para solicitar informações sobre a reclamação efetuada.

Em situações dentro da normalidade, o Banco Central demora em torno de 08 a 10 dias úteis para dar uma resposta ao cidadão. Mas esse prazo depende muito de quanto tempo o Banco que foi reclamado vai demorar para responder.

Se a sua reclamação for justa, normalmente o Banco volta atrás no seu procedimento ou de alguma forma busca corrigir o erro cometido, notificando -se ao Banco Central sobre esta ocorrência.

Logicamente que se a sua reclamação junto ao Banco Central for Improcedente, nenhuma ação será feita, pois o Banco Central vai analisar o seu caso e repassar para a instituição, servindo nesse caso de mediador do problema.

Com foi dito anteriormente, é muito simples fazer uma reclamação no Banco Central. O procedimento é todo realizado Online, sendo importante que você cadastre um e-mail para receber notificações cada vez que o processo for movimentado.

Outra questão muito importante a ser lembrada é a necessidade de você ter em mãos o protocolo de entrada da reclamação no Banco. Tenha este número em mãos pois você vai precisar dele na hora de fazer as suas alegações.

Importante esclarecer também que o Banco Central vai solicitar que você faça um texto explicando exatamente o que aconteceu entre você e o banco. Neste momento, seja o mais detalhista possível, informando dia, hora, nome do atendente, o que foi dito, número de protocolo, etc. Não deixe passar nada!

Passo a passo: fazendo a reclamação no Site do Banco Central

Para iniciar o procedimento de reclamação no Banco Central, você pode clicar aqui.

Como você pode ver na imagem acima, você deve informar o número do seu CPF e selecionar Reclamação contra Instituições do Sistema Financeiro.

Resolva o Captha e a tela será aberta para que você preencha os dados necessário:

- Escolha o nome da Instituição

- Selecione o Assunto

- Digite a sua mensagem, constando a reclamação que você quer fazer

- Informe o número do protocolo da Instituição Financeira

A partir daí o Banco Central vai pedir o seu e-mail e telefone, gerando o protocolo de atendimento depois disso.

Com o protocolo de reclamação em mãos, como foi informado acima, você só precisa aguardar a resposta do banco sobre a sua reclamação.

Perguntas e Respostas sobre a Reclamação no Banco Central

1- Quais as instituições que o Banco Central supervisiona?

São supervisionados pelo Banco Central os bancos múltiplos, bancos comerciais, bancos cooperativos, bancos de investimento, bancos de desenvolvimento, bancos de câmbio, caixas econômicas, cooperativas de crédito, sociedades de crédito, financiamento e investimento, sociedades de crédito imobiliário, sociedades de arrendamento mercantil, sociedades corretoras de câmbio, sociedades corretoras de títulos e valores mobiliários, sociedades distribuidoras de títulos e valores mobiliários, agências de fomento, companhias hipotecárias, sociedades de crédito ao microempreendedor e à empresa de pequeno porte, instituições de pagamento e administradoras de consórcio.

2- Posso registrar uma reclamação contra uma Instituição autorizada a funcionar pelo Banco Central?

sim, as reclamações podem ser apresentadas pelos clientes e usuários de produtos e serviços das instituições financeiras e demais instituições autorizadas a funcionar pelo Banco Central, a exemplo das cooperativas de crédito, instituições de pagamento e administradoras de consórcios, sempre que se verificarem indícios de descumprimento de dispositivos legais e regulamentares cuja fiscalização esteja afeta a esta Autarquia.

3- A reclamação no Banco Central tem os mesmos efeitos que uma ação na justiça?

Não. O Banco Central atua na esfera administrativa e não substitui a ação na justiça. Portanto, caso o seu problema não seja resolvido junto ao Banco Central, você poderá ingressar com uma ação judicial.

4- O Banco Central regula o tempo para espera em fila do banco?

Não. O Banco Central não regulamenta o tempo de espera em filas. Existem leis estaduais e municipais que tratam do assunto. Cabe aos órgãos de defesa do consumidor (Procon, Prodecon, Decon) a orientação sobre o tema.

5- O Banco Central tabela o valor das tarifas cobradas pelos bancos?

O Banco Central não determina valores de tarifas. Entretanto, existem alguns serviços que os bancos devem fornecer gratuitamente. Respeitadas as proibições, cada instituição é livre para estabelecer o valor de suas tarifas.

Entrar com Ação Judicial contra Banco: vale a pena?

Muitas pessoas se perguntam se vale a pena entrar com uma ação judicial contra um Banco. Será que é viável? Vale a pena? Para responder essa pergunta, antes de tudo, é necessário saber qual a extensão do seu problema com a instituição bancária.

Sabemos que a maior parte dos problemas que envolvem os clientes e os bancos são questões mais simples de serem resolvidas através de uma reclamação na ouvidoria do próprio banco ou mesmo com uma manifestação junto ao Banco Central.

No entanto, quando a situação é mais complicada e envolve valores maiores, o cliente pode pensar em entrar com uma ação judicial contra a instituição financeira, já sabendo que isso será em último caso, após esgotar as vias administrativas de resolução do conflito.

Uma opção para quem não conseguiu resolver a questão nas vias convencionais é entrar com uma ação no Juizado Especial Cívil da sua região, que é o órgão competente para processar causas de no máximo 40 salários mínimos. Importante frisar que, para causas inferiores a 20 salários mínimos, não é obrigatório constituir advogado.

Uma outra vantagem dos JEFS que também não pode ser esquecida é a ausência de custas processuais aos litigantes, ou seja, você não vai precisar pagar nada para entrar com uma ação contra o Banco.

Para ter êxito em um processo junto ao Juizado de Pequenas Causas é importante que você reúna o maior número de documentos possíveis, como contratos, extratos bancários, e-mails, cartas de cobrança, comprovantes de pagamento, etc.

Outra coisa fundamental neste tipo de processo é ter em mãos todos os dados do Banco contra o qual você vai entrar com a ação judicial: endereço, telefone, Cnpj, nome do gerente, entre outras informações importantes para que os servidores da justiça possam localizar o agente financeiro.

E como foi dito anteriormente, não existe a necessidade de constituir advogado, embora se você tiver condições, isso é extremamente indicado, considerando que em casos mais complexos o auxílio de um especialista vai ser essencial para que você tenha sucesso na lide.

Desta forma, já sabendo de todos os detalhes sobre como entrar com uma ação judicial contra um banco, cabe somente a você decidir se isso é ou não viável, se é a melhor solução ou não.

Outras formas de reclamação contra um Banco

Se você não sabe, hoje em dia existem diversas formas de reclamar e demonstrar o seu descontentamento com o atendimento bancário. Isso quer dizer que você não é obrigado a aceitar qualquer tipo de ilegalidade por parte de algum agente do sistema financeiro do país.

Infelizmente hoje em dia acontecem os mais variados tipos de irregularidades em operações bancárias. São pessoas que estão pagando juros ou taxas abusivas, outras estão com o nome negativado sem dever nem mesmo um centavo, enfim, são reclamações de todo tipo.

Se assim como muitos brasileiros você também tem reclamações a fazer sobre o atendimento ou serviço bancário, saiba que a sociedade cada vez mais tem criado mecanismos para dar voz às pessoas insatisfeitas. Vamos aqui lhe indicar apenas alguns exemplos de como você pode reclamar de práticas abusivas por parte do bancos.

Você pode escolher entre algumas das formas de reclamação ou pode até mesmo utilizar todas elas, até que o seu problema seja finalmente resolvido. Lembrando que antes de tudo é importante tentar solucionar o problema junto ao banco do qual você tem reclamações a fazer e só depois disso você pode partir para outras ações no sentido de resguardar o seu direito.

Site Reclame aqui

O Site Reclame Aqui é uma plataforma privada, mas que tem ajudado muitas pessoas a solucionarem os seus problemas junto às instituições financeiras como o Banco Inter por exemplo, que tem um boa reputação na plataforma.

O Reclame Aqui funciona da seguinte maneira: a pessoa que quer fazer uma reclamação se cadastrar no site, faz a sua manifestação por escrito, podendo apresentar os documentos que achar necessário e conclui o pedido com a geração de um protocolo.

Após isso, o próprio site Reclame Aqui entra em contato com a empresa reclamada, que normalmente informa qual a sua versão para os fatos e muitas vezes soluciona o problema do cliente.

A maioria das empresas atendem muito bem às reclamações feitas nesta plataforma, outras nem mesmo respondem. Mas de uma maneira em geral, vale a pena tentar fazer uma reclamação no site. Acesse aqui para conhecer o serviço.

Procon

Um órgão bastante conhecido dos brasileiros é o Procon, sempre muito lembrado pela luta na defesa do consumidor, o Procon é vinculado aos Estados e atende toda a população quando o assunto é código de defesa do consumidor.

Se você tiver fácil acesso a este órgão, pode ser uma alternativa viável uma reclamação junto ao Procon. Sabe-se que as instituições financeiras como um todo, especialmente os Bancos costumam ter sérios problemas com os seus clientes, e o Procon pode ser o defensor do lado mais fraco neste momento.

Uma outra vantagem de procurar o Procon para uma reclamação é o fato de ser um serviço de utilidade pública, ou seja, totalmente gratuito, no qual o consumidor pode ter um braço forte em sua defesa contra o abuso de poder de grandes corporações.

Peguntas e Respostas sobre o Superbancodigital

O que é a Superdigital? Como ser Superdigital?

É uma conta digital onde você pode comprar e sacar nos caixas da Rede Banco24Horas com o cartão Internacional Mastercard®; Receber e transferir dinheiro para qualquer banco, receber seu salário, fazer compras em estabelecimentos ou online no mundo todo e controlar a sua vida financeira. Aqui é assim: #ContaPraTodoMundo.

Para abrir a sua conta Superdigital é só você baixar o aplicativo Superdigital na Play Store ou App Store ou entrar no site da Superdigital www.superdigital.com.br e clicar em “Abra sua conta“.

Você só precisa ter um e-mail válido que costuma acessar e também precisará do número do seu celular, além dos seus documentos pessoais 🙂 e um celular smartphone para ter acesso a todos os serviços que oferecemos.

Como entro em contato com a Superdigital?

Você pode tirar suas dúvidas através do próprio aplicativo, clicando no menu “Mais“, depois em “Ajuda” e no “Chat“.

Mas se preferir, pode ligar para a nossa Central de Atendimento no telefone 4090-1450 (Capitais e Regiões Metropolitanas) ou 0800-090-1450 (Demais localidades), de segunda a sexta-feira, das 8h às 20h.

Onde posso sacar usando meu cartão Superdigital?

| Você pode sacar na rede do Banco24Horas e na rede compartilhada Santander em todo o Brasil. Se estiver no exterior, use os caixas da Rede Cirrus® para sacar. |

O que posso fazer com a Superdigital?

A Superdigital é quase uma conta de banco, mas sem dor de cabeça. Confira tudo o que você consegue fazer:

– Receber e transferir dinheiro para qualquer banco;

– Fazer compras na padaria, mercado, fármacia e em qualquer lugar que aceite a bandeira Mastercard® no mundo todo;

– Comprar em sites e aplicativos nacionais e internacionais com o cartão virtual;

– Pagar contas de água, luz, boletos e tudo que quiser direto pelo aplicativo ou site;

– Fazer saques nos caixas da rede Banco24Horas e rede compartilhada Santander;

– Fazer saques internacionais pelos caixas da rede Cirrus®;

– Recarregar o celular;

– Recarregar o Bilhete Único (na cidade de São Paulo).