Crefisa is a company that grants personal credit through its own resources, already having 1 million customers spread across Brazil, in addition to operating in more than 500 cities.

It is one of the companies that allows you to take out payroll loans or loans with the lowest interest rates on the market. And as the company's slogan says, come and get instant money!

Crefisa Telephone

Crefisa's headquarters are in the city of São Paulo. However, there are several physical branches spread throughout Brazil, where you can access credit, have questions about your account and other issues that can be resolved with Crefisa's managers.

Main Agency Telephone São Paulo: 11 3897-6200

Whatsapp Crefisa

You can talk to Crefisa via WhatsApp, through Cris, who is a Virtual Assistant.

Call Cris at 11 94582-1680;

SAC Crefisa

If you are having difficulty paying your installment or even need information to pay off your payroll loan, but were unsuccessful in receiving service at a physical branch, it is time to contact Crefisa's SAC.

The telephone number is 0800 727 4884.

Social media

Crefisa always announces the expansion of its services or even new developments through its social networks. Don't waste any more time and click on each of the links to follow Crefisa:

Crefisa Physical Agencies

Crefisa operates in over 500 cities throughout Brazil, helping people with limited access to credit, building dreams and boosting the economy. Check out some physical branches here and see which one is closest to you:

São Paulo

Main Unit: R. Canadá, 387, Jardim América – Telephone: 11 3897-6200

Campinas: Francisco Glicério Avenue, 632, Center – Telephone: 19 3231-0221

Santos: R. Goitacazes, 23, Gonzaga – Center – Telephone: 13 3323-0035

São Caetano do Sul: R. Visc. de Inhaúma, 951, Oswaldo Cruz – Telephone: 11 4232-0310

Rio Grande do Sul

Porto Alegre: Alberto Bins Avenue, 720, Historic Center – Telephone: 51 3222-6289

Passo Fundo: Bento Gonçalves Street, 598, Center – Telephone: 54 3313-7555

Caxias do Sul: R. Cel Flores, 405, São Pelegrino – Telephone: 54 3215-2166

Bento Gonçalves: R. Mal. Deodoro 308, Center – Telephone: 54 3451-3734

Santa Catarina

Florianópolis: R. Felipe Schmidt, 55, Center – Telephone: 48 3039-1126

Balneário Camboriú: Av. Brasil, 1811, Center – Telephone: 47 3268-1940

Lages: R. Quintino Bocaíuva, 70, Center – Telephone: 49 3224-4692

Chapecó: Getúlio Dorneles Vargas Avenue, 135, Center – Telephone: 49 3222-1143

Paraná

Curitiba: 7535, Boqueirão – Telephone: 41 3278-2275

Londrina: R. Sergipe, 1110, Center – Telephone: 43 3336-3825

Maringá: Tamandaré Avenue, 1007, Zone 01 – Telephone: 44 3255-2463

Foz do Iguaçu: Av. Republica Argentina, 3265, Center – Telephone: 45 3526-0485

Rio de Janeiro

Rio de Janeiro: Jacarepaguá Station, 7187, Store G, Parish of Jacarepaguá – Telephone: 21 3415-0341

Niterói: Ernani do Amaral Peixoto Avenue, 334, Center – Telephone: 21 2620-0387

Teresopolis: Av.

Minas Gerais

Belo Horizonte: R. Cap. Nelson Albuquerque, 59, Venda Nova – Telephone: 31 3457-8750

Juiz de Fora: 2641 Barão do Rio Branco Avenue, Downtown – Telephone: 32 3213-2552

Crefisa Ombudsman

There may always be some pending issue regarding your service or in relation to the loan you requested from Crefisa. With this in mind, the company devises strategies 24 hours a day through its Official Channel, the Crefisa Ombudsman.

Call the 4004-4001, option 2, for those who are in capitals and metropolitan regions. And if you are from other regions, the phone number is 0800 722 444. On Saturdays, there is also service from 8 am to 3 pm. The ombudsman can also help you with closing a loan, without having to go to one of the branches.

Crefisa's ombudsman is a specific body that exists within the company and plays a very important role.

This is because it is through this sector, the ombudsman's office, that Crefisa is able to evaluate, identify and monitor the service standard of its staff.

In general, people end up contacting an ombudsman when they have a problem with the company and the regular customer service, unfortunately, cannot resolve the issue.

The ombudsman, therefore, must listen to its customers' complaints and has the duty to ensure that the demand is always investigated and evaluated in an impartial and fair manner.

Each company defines its own approach and the way the sector operates. Some, for example, end up choosing to outsource this service in order to ensure greater impartiality.

Others choose to select the company's own employees, who are already familiar with the company's values, exchange or return policy, and refund processes.

At the Ombudsman's Office, you can submit compliments, suggestions, requests, complaints, statements and claims.

The interesting thing about the ombudsman is that, in addition to investigating your issue, it also has an effect on the company.

Difference between ombudsman and customer service

Many people end up wondering about the difference between the ombudsman and the SAC, or they end up getting confused when choosing which service channel is most appropriate for their needs.

Therefore, it is very important to know the difference between an ombudsman and a customer service department.

SAC, also known as Customer Service, is a channel made available by companies to meet the initial demands of a consumer.

At SAC, you can request information, clarify doubts, cancel your purchase and even make a complaint.

Please note that complaints to SAC have a time limit to be resolved: 5 days from the date your complaint is registered.

Some companies, such as telephone, energy, cable television, air or road transport companies, banks or health insurance companies, are required to offer a customer service channel through SAC.

Others, on the other hand, are not required to create this channel. However, if you really care about your service, it may be interesting to offer a customer service center.

The ombudsman's office, on the other hand, should not be your first contact with the company, as it is a channel for investigating problems. In many cases, it is necessary to present the protocol number obtained from the SAC.

When to contact an ombudsman

Therefore, the answer to when to contact an ombudsman is already very clear.

Crefisa's ombudsman should be contacted after all possibilities of negotiations and contacts with the company through the most traditional channels have been exhausted.

Therefore, consider contacting an ombudsman as your last resort, as a specific channel to open a report about your problem.

Leave it until you contact the ombudsman when your problem is not resolved by customer service.

How an ombudsman works

Crefisa's ombudsman, upon receiving your complaint, will receive each piece of information presented by the customer.

The employee will then check the service and see if there are any errors. If an error is found, the company will receive feedback with “corrective measures” to prevent this type of thing from happening again.

In general, the ombudsman service usually works very well! They do a very serious job and consumers usually evaluate the service as positive and, above all, satisfactory.

If you still haven't resolved your problem, a great way to contact the company and force them to resolve the issue without necessarily starting a lawsuit is Reclame Aqui.

Reclame Aqui is one of the best and most efficient communication channels between consumers and companies.

There, the response rate is usually high, as is the resolution rate.

Complaint to the Central Bank of Brazil

Many users of banking services do not know, but when they have some kind of problem with a bank and the bank does not resolve it through its ombudsman, a very practical and viable alternative is to make a complaint to the Central Bank.

The Central Bank of Brazil is a highly regarded institution and, among other responsibilities, it is responsible for regulating and supervising the national financial system. The institution also currently works to ensure the stability of the purchasing power of money.

In the specific case of Banks, the Central Bank supervises and controls banking institutions, aiming to prevent abuses and other arbitrary acts that may be committed by the country's financial agents.

Therefore, if you had a more serious problem with Crefisa or any other financial institution and this problem was not resolved by the ombudsman, you can register your complaint very simply on the Central Bank website.

Once the complaint has been made, the Central Bank will contact Crefisa directly to request information about the complaint made.

In normal situations, the Central Bank takes around 8 to 10 business days to respond to the citizen. However, this period depends largely on how long the bank that was complained about takes to respond.

If your complaint is fair, the Bank will usually reverse its procedure or in some way seek to correct the error made, notifying the Central Bank about this occurrence.

Logically, if your complaint to the Central Bank is unfounded, no action will be taken, as the Central Bank will analyze your case and forward it to the institution, acting in this case as a mediator of the problem.

As previously mentioned, it is very simple to file a complaint with the Central Bank. The entire procedure is carried out online, and it is important that you register an email address to receive notifications each time the process is processed.

Another very important point to remember is the need to have the complaint receipt protocol at the Bank on hand. Have this number on hand as you will need it when making your claims.

It is also important to clarify that the Central Bank will ask you to write a text explaining exactly what happened between you and the bank. At this point, be as detailed as possible, providing the date, time, name of the attendant, what was said, protocol number, etc. Don't leave anything out!

Step by step: making a complaint on the Central Bank website

To initiate the complaint procedure at the Central Bank, you can click here.

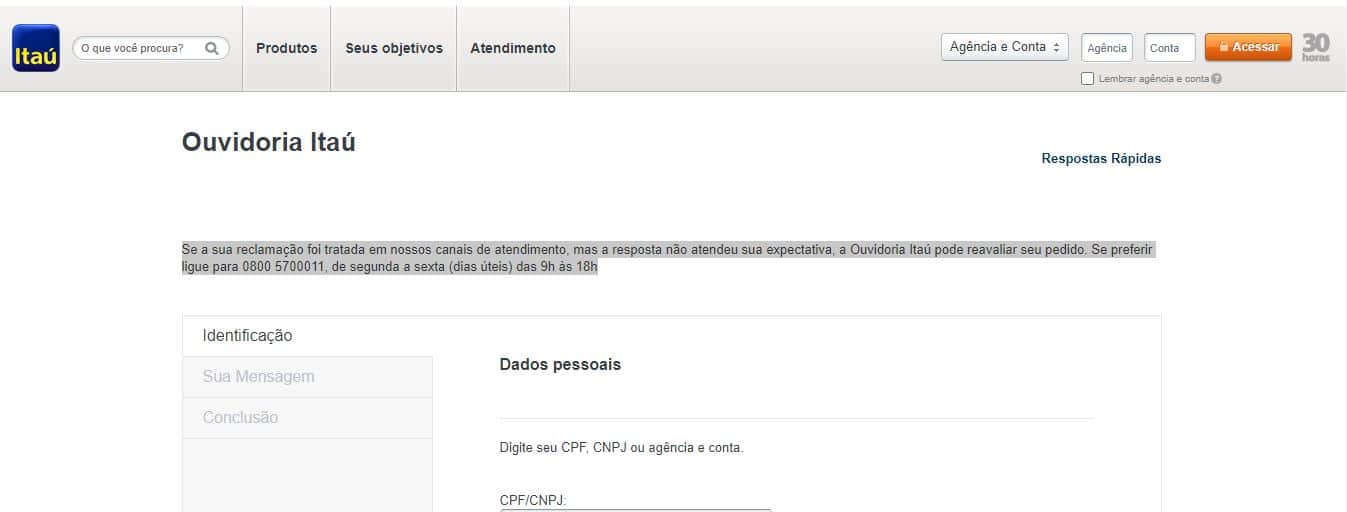

As you can see in the image above, you must enter your CPF number and select Complaint against Financial System Institutions.

Solve the Captha and the screen will open for you to fill in the necessary data:

- Choose the name of the Institution

- Select Subject

- Enter your message, stating the complaint you want to make

- Enter the Financial Institution's protocol number

From there, the Central Bank will ask for your email and telephone number, generating the service protocol after that.

With the complaint protocol in hand, as stated above, you just need to wait for the bank's response regarding your complaint.

Questions and Answers about Complaints at the Central Bank

1- Which institutions does the Central Bank supervise?

The Central Bank supervises multiple banks, commercial banks, cooperative banks, investment banks, development banks, exchange banks, savings banks, credit unions, credit, financing and investment companies, real estate credit companies, leasing companies, exchange brokerage companies, securities brokerage companies, securities distribution companies, development agencies, mortgage companies, credit companies for microentrepreneurs and small businesses, payment institutions and consortium administrators.

2- Can I file a complaint against an Institution authorized to operate by the Central Bank?

Yes, complaints may be filed by customers and users of products and services from financial institutions and other institutions authorized to operate by the Central Bank, such as credit unions, payment institutions and consortium administrators, whenever there is evidence of non-compliance with legal and regulatory provisions whose supervision is the responsibility of this Agency.

3- Does a complaint to the Central Bank have the same effects as a lawsuit?

No. The Central Bank acts in the administrative sphere and does not replace legal action. Therefore, if your problem is not resolved by the Central Bank, you can file a lawsuit.

4- Does the Central Bank regulate the waiting time in bank queues?

No. The Central Bank does not regulate waiting times in queues. There are state and municipal laws that address this issue. It is up to consumer protection agencies (Procon, Prodecon, Decon) to provide guidance on this topic.

5- Does the Central Bank set the value of fees charged by banks?

The Central Bank does not determine the amount of fees. However, there are some services that banks must provide free of charge. Subject to the prohibitions, each institution is free to establish the amount of its fees.