The Blubank telephone number is a highly requested piece of information by customers of this institution, always with the aim of receiving information, making complaints or clarifying doubts.

One of the biggest fears of Brazilians is entering the SPC or Serasa. And after that, the fear of never having a Credit Card accepted again.

This does not happen with Blubank customers, which is a digital bank that approves your registration without a credit analysis.

Blubank Business Phone

Although there is no specific telephone number at a Branch or even to deal with problems at an Ombudsman's Office, you have a specific Blubank extension for commercial contact.

You can contact us from Monday to Friday

from 9:00 to 18:00 by phone

0800 729 0413 or (13) 3317-2717 Or by email:

[email protected]

Blubank Card Operating Method

For those who still have little knowledge about the Blubank system, it is quite easy to be approved and have a very high pre-approved limit. Many customers, even those with negative credit ratings in the SPC, can get an initial limit of up to R$3,500.00.

But pay attention to one detail: The Blubank card only works with top-ups, so you will need to deposit at least R$37.50 every month to be able to use Blubank.

Partnership with MasterCard

Mastercard is the largest brand in the world, and is also the most accepted in millions of establishments in Brazil and other countries. And it also has no complications for those with bad credit.

Blubank digital account

Through the Blubank card, you have access to a digital 100% account. It's all very easy and straightforward.

Application

Through the app, you can check your balance, statement, top up your card and cell phone, as well as pay your bills using your balance. You can download this app from the official Apple Store and also from Google Play.

Fee statement

If you happen to apply for a loan of R$3,000.00 and are accepted, you can start paying in 15 installments. The first payment must be made within 60 days after signing the contract and with interest of R$5.991 per month.

In the end, you will pay 15 installments of R$ 334.69 and this also includes an additional R$ 68.89, which is the IOF - Tax on Financial Transactions. The total effective cost of this transaction will be 6.20% per month.

Social media

Follow Blubank on social media to stay up to date with all the latest news almost in real time. See below the link to access the main fan pages:

Many people still have doubts about Blubank's services. But you can rest assured and be supported, after all, the company has a CNPJ and its physical address is EIRELI. This ensures that the Financial Institution has only one partner.

It has been on the market for some time now, present on online complaint reporting platforms such as Reclame Aqui, which ensures that this company has all possible transparency with its customers.

Learn more about Blubank. Watch the video:

Tips for using your Blubank card correctly

According to Blubank's own website, every customer already knows that applying for a Blubank card will be free from all bureaucracy. It can come in the MasterCard, Elo or Visa brands. You can also issue your purchases through Allbank.

And together with your card, the customer has access to the 100% account app, available to make transfers directly from the prepaid card, withdrawals at traditional and 24-hour banks, in addition to having a high limit to be able to control your purchases more easily throughout the month.

Hurry up and order your Blubank.

Complaint to the Central Bank of Brazil

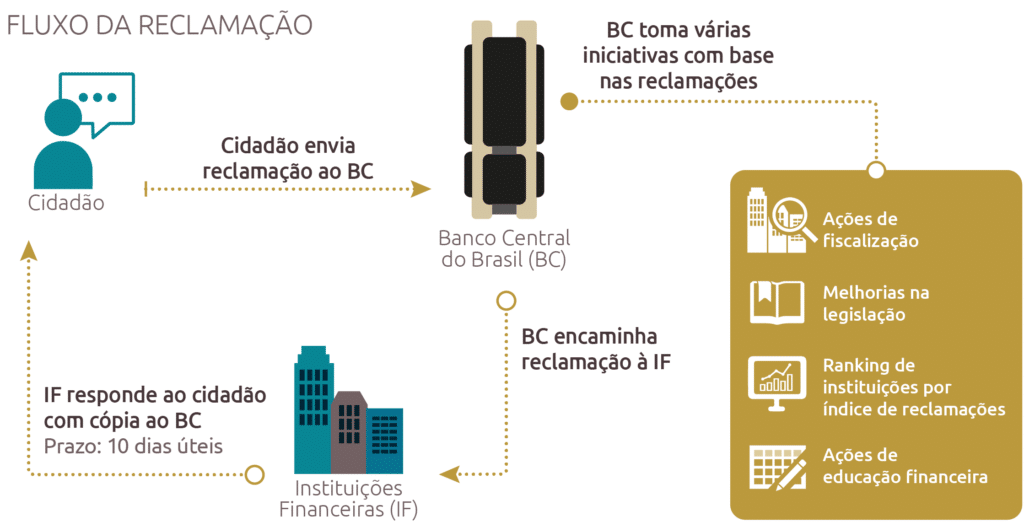

Many users of banking services do not know, but when they have some kind of problem with a bank and the bank does not resolve it through its ombudsman, a very practical and viable alternative is to make a complaint to the Central Bank.

The Central Bank of Brazil is a highly regarded institution and, among other responsibilities, it is responsible for regulating and supervising the national financial system. The institution also currently works to ensure the stability of the purchasing power of money.

In the specific case of Banks, the Central Bank supervises and controls banking institutions, aiming to prevent abuses and other arbitrary acts that may be committed by the country's financial agents.

So if you had a more serious problem with the Blubank or any other financial institution and this problem was not resolved by the ombudsman, you can register your complaint very simply on the Central Bank website.

Once the complaint has been made, the Central Bank will contact the Blubank to request information about the complaint made.

In normal situations, the Central Bank takes around 8 to 10 business days to respond to the citizen. However, this period depends largely on how long the bank that was complained about takes to respond.

If your complaint is fair, the Bank will usually reverse its procedure or in some way seek to correct the error made, notifying the Central Bank about this occurrence.

Logically, if your complaint to the Central Bank is unfounded, no action will be taken, as the Central Bank will analyze your case and forward it to the institution, acting in this case as a mediator of the problem.

As previously mentioned, it is very simple to file a complaint with the Central Bank. The entire procedure is carried out online, and it is important that you register an email address to receive notifications each time the process is processed.

Another very important point to remember is the need to have the complaint receipt protocol at the Bank on hand. Have this number on hand as you will need it when making your claims.

It is also important to clarify that the Central Bank will ask you to write a text explaining exactly what happened between you and the bank. At this point, be as detailed as possible, providing the date, time, name of the attendant, what was said, protocol number, etc. Don't leave anything out!

Step by step: making a complaint on the Central Bank website

To initiate the complaint procedure at the Central Bank, you can click here.

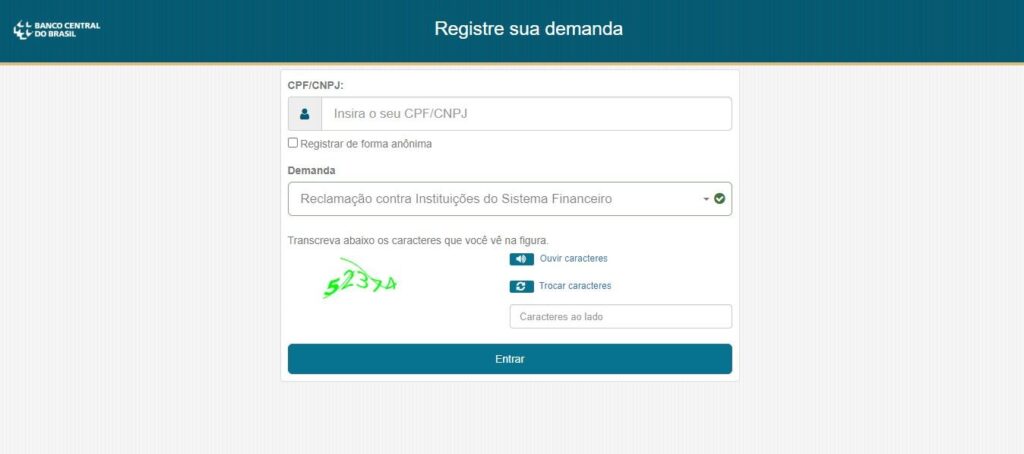

As you can see in the image below, you must enter your CPF number and select Complaint against Financial System Institutions.

Solve the Captha and the screen will open for you to fill in the necessary data:

- Choose the name of the Institution

- Select Subject

- Enter your message, stating the complaint you want to make

- Enter the Financial Institution's protocol number

From there, the Central Bank will ask for your email and telephone number, generating the service protocol after that.

With the complaint protocol in hand, as stated above, you just need to wait for the bank's response regarding your complaint.

Questions and Answers about Complaints at the Central Bank

1- Which institutions does the Central Bank supervise?

The Central Bank supervises multiple banks, commercial banks, cooperative banks, investment banks, development banks, exchange banks, savings banks, credit unions, credit, financing and investment companies, real estate credit companies, leasing companies, exchange brokerage companies, securities brokerage companies, securities distribution companies, development agencies, mortgage companies, credit companies for microentrepreneurs and small businesses, payment institutions and consortium administrators.

2- Can I file a complaint against an Institution authorized to operate by the Central Bank?

Yes, complaints may be filed by customers and users of products and services from financial institutions and other institutions authorized to operate by the Central Bank, such as credit unions, payment institutions and consortium administrators, whenever there is evidence of non-compliance with legal and regulatory provisions whose supervision is the responsibility of this Agency.

3- Does a complaint to the Central Bank have the same effects as a lawsuit?

No. The Central Bank acts in the administrative sphere and does not replace legal action. Therefore, if your problem is not resolved by the Central Bank, you can file a lawsuit.

4- Does the Central Bank regulate the waiting time in bank queues?

No. The Central Bank does not regulate waiting times in queues. There are state and municipal laws that address this issue. It is up to consumer protection agencies (Procon, Prodecon, Decon) to provide guidance on this topic.

5- Does the Central Bank set the value of fees charged by banks?

The Central Bank does not determine the amount of fees. However, there are some services that banks must provide free of charge. Subject to the prohibitions, each institution is free to establish the amount of its fees.

Taking Legal Action Against a Bank: Is It Worth It?

Many people wonder whether it is worth taking legal action against a bank. Is it feasible? Is it worth it? To answer this question, first of all, you need to know the extent of your problem with the banking institution.

We know that most of the problems involving customers and banks are issues that are easier to resolve through a complaint to the bank's own ombudsman or even by making a statement to the Central Bank.

However, when the situation is more complicated and involves larger amounts, the customer may consider filing a lawsuit against the financial institution, knowing that this will be a last resort, after exhausting administrative avenues for resolving the conflict.

One option for those who were unable to resolve the issue through conventional means is to file a lawsuit in Small Claims Court in your region, which is the competent body to process cases of up to 40 minimum wages. It is important to emphasize that, for cases of less than 20 minimum wages, it is not mandatory to appoint a lawyer.

Another advantage of JEFS that cannot be forgotten is the absence of legal costs for litigants, that is, you will not need to pay anything to file a lawsuit against the Bank.

To be successful in a case before the Small Claims Court, it is important that you gather as many documents as possible, such as contracts, bank statements, emails, collection letters, proof of payment, etc.

Another fundamental thing in this type of process is to have all the details of the Bank against which you are going to file the lawsuit: address, telephone number, CNPJ, name of the manager, among other important information so that the justice officials can locate the financial agent.

And as previously mentioned, there is no need to hire a lawyer, although if you have the means, this is highly recommended, considering that in more complex cases the assistance of a specialist will be essential for you to be successful in the dispute.

Therefore, now that you know all the details about how to file a lawsuit against a bank, it is up to you to decide whether or not this is viable, whether it is the best solution or not.

Other forms of complaint against a Bank

If you don't know, nowadays there are several ways to complain and show your dissatisfaction with banking services. This means that you are not obliged to accept any type of illegality on the part of any agent of the country's financial system.

Unfortunately, nowadays, all sorts of irregularities occur in banking transactions. People are paying excessive interest or fees, others have their credit ratings listed without owing a single cent. In short, there are all sorts of complaints.

If, like many Brazilians, you have complaints about banking services or customer service, you should know that society has increasingly created mechanisms to give voice to dissatisfied people. Here we will give you just a few examples of how you can complain about abusive practices by banks.

You can choose between some of the complaint methods or you can even use all of them until your problem is finally resolved. Remember that first of all it is important to try to resolve the problem with the bank you have complaints about and only after that you can take other actions to protect your rights.

Complain here website

The Reclame Aqui website is a private platform, but it has helped many people solve their problems with financial institutions such as the Blubank for example, that has a good reputation on the platform.

Reclame Aqui works as follows: the person who wants to make a complaint registers on the website, makes their statement in writing, being able to present any documents they deem necessary and completes the request by generating a protocol.

After this, the Reclame Aqui website itself contacts the company complained about, which normally informs its version of the facts and often solves the customer's problem.

Most companies respond very well to complaints made on this platform, while others don't respond at all. But in general, it's worth trying to make a complaint on the website. Access here to learn about the service.

Procon

A well-known body among Brazilians is Procon, always remembered for its fight to defend consumers. Procon is linked to the States and serves the entire population when it comes to consumer protection codes.

If you have easy access to this body, a complaint to Procon may be a viable alternative. It is known that financial institutions as a whole, especially banks, often have serious problems with their customers, and Procon may be the defender of the weaker side at this time.

Another advantage of seeking out Procon to file a complaint is the fact that it is a public service, that is, completely free, in which the consumer can have a strong arm in their defense against the abuse of power by large corporations.

Important Notice

The Achei Celular website is an independent project that has no connection with the Blubank nor with government consumer protection entities. The purpose of this article was only to inform about the telephone number of the Blubank and other forms of contact with the institution, for informational purposes only. If you have any complaints to make, look for the companies' official channels and under no circumstances leave any personal data in the comments field.