In the competitive dating app market, the Bumble recently faced an unexpected turn of events that shook investor confidence. After significantly revising its growth forecasts, the company saw its shares plummet, reflecting a negative market reaction.

This event highlights the fragility that can arise when growth expectations are not met, especially in an industry where constant innovation and financial performance are crucial. Below, we explore the key reasons behind Bumble’s stock drop and the potential impact on the company and its investors.

Review of Growth Forecasts and Impact on Shares

On Wednesday, Bumble announced a drastic reduction in its annual revenue growth forecast, dropping it from an expected range of 8% to 11% to between 1% and 2%. This significant adjustment in expectations not only surprised the market, but also triggered an immediate and severe backlash.

Bumble shares fell as low as 30% in after-hours trading, and by the next morning, they were down to over 35%. Such a sharp drop reflects a loss of investor confidence and raises questions about the company's ability to achieve its financial and strategic goals.

The forecast revision was driven by second-quarter revenue, which fell short of analysts' estimates and totaled $268.6 million, compared to expectations of $273 million.

See also: Gas Voucher on the app: find out how to check the receipt date in AUGUST

Comparison with Competitors and Second Quarter Performance

Bumble’s slowdown in growth comes as its main competitors, such as Match Group, have reported stronger financial results. Match Group reported upbeat second-quarter revenue, while Tinder showed signs of stabilization and Hinge showed robust growth. This comparison underscores the difficulty Bumble faces in aligning its performance with market expectations.

Additionally, Bumble’s Q3 revenue forecast, which ranges from $269 million to $275 million, is below the average analyst estimate of $296.1 million. These numbers reflect a less promising growth trajectory and contribute to growing pessimism about the company’s ability to generate sustainable and breakthrough revenue.

Company Growth and Future Initiatives

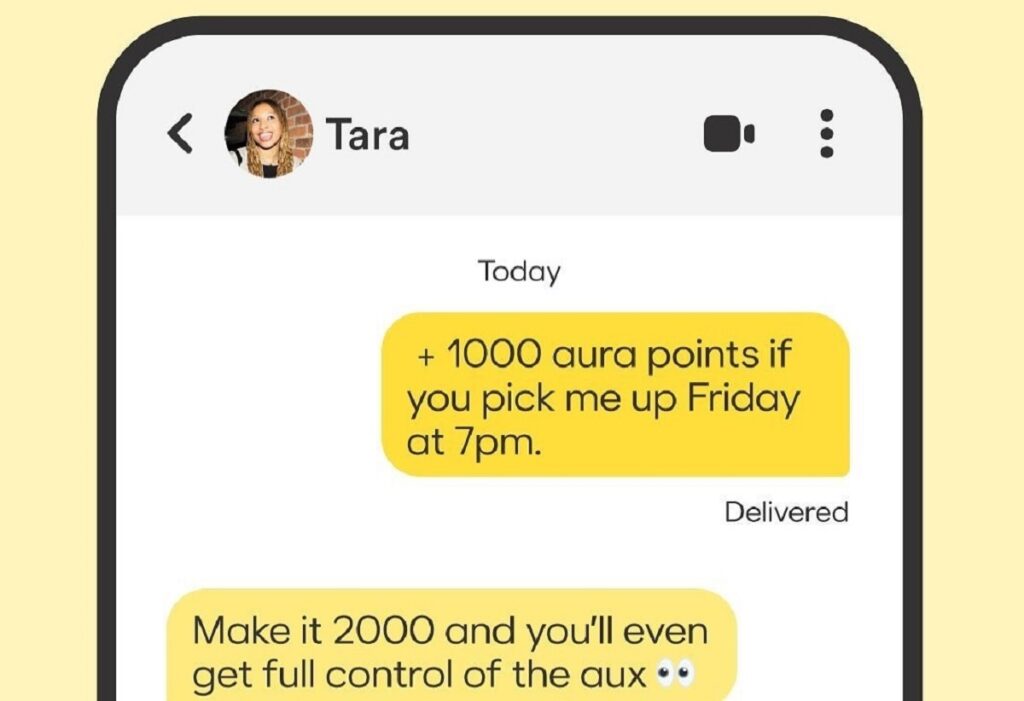

Despite recent challenges, Bumble continues to invest in innovations to improve its platform and attract new users. The company plans to launch new features, including an updated chat-starting system and an AI-powered photo picker to make it easier to create profiles. These additions are intended to provide a more engaging and personalized experience for users. This could help reverse negative perceptions and drive future growth.

The increase in the number of paid users, which rose to 4.1 million in the quarter, compared to 3.6 million a year ago, also suggests a growing customer base. However, the success of these initiatives will be crucial to restoring investor confidence and ensuring a more stable future for the company.

The recent turmoil in Bumble’s stock serves as a reminder of the complexities and challenges facing technology companies in the dating space. Revising growth forecasts and comparing them to competitors highlights the importance of meeting market expectations and continually innovating to remain competitive. Bumble’s future success will depend on its ability to effectively implement its new strategies and regain investor confidence.

See also: PIX International in the app reaches 6 countries and may expand; check it out